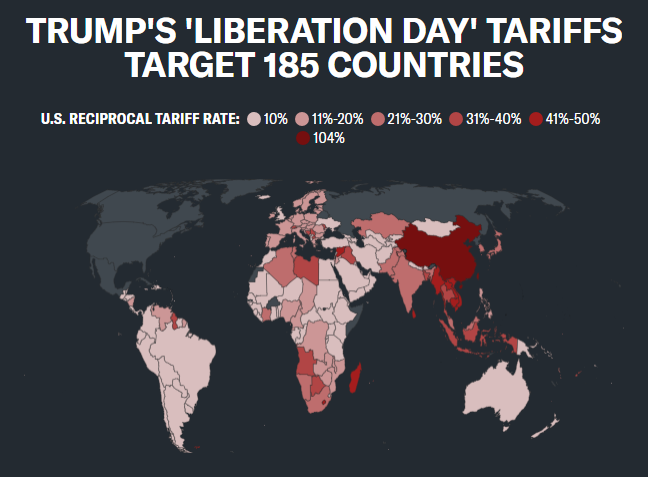

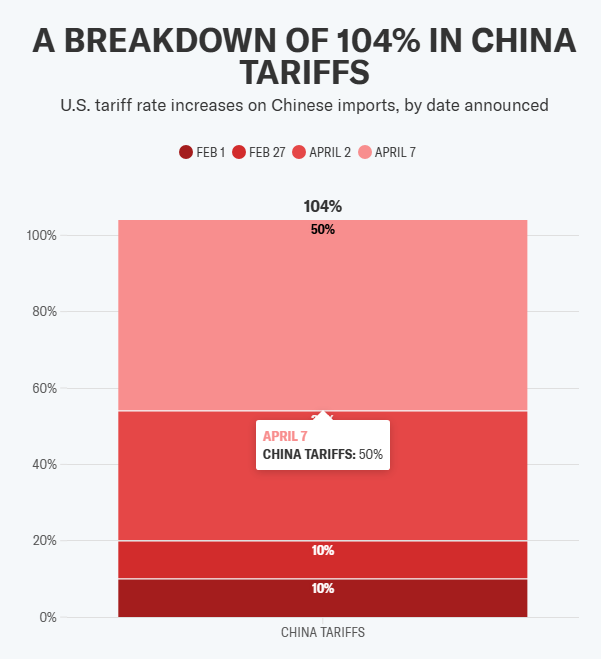

Since President Trump took office, the U.S. government has implemented aggressive tariff policies, particularly targeting Chinese imports. In early 2025, the Trump administration introduced a comprehensive “reciprocal tariff” plan, imposing a 10% base tariff on all imported goods, with a notable increase for Chinese products. After months of escalating tensions, on April 2nd, 2025, Trump announced an additional 34% tariff on Chinese goods, marking a significant increase in trade pressure. These tariffs are cumulative, meaning that from April 9th onwards, Chinese imports will face a total tariff rate of 54%. Moreover, following China’s retaliatory actions, Trump warned that tariffs could rise even higher, potentially reaching 104% if China does not cancel its 34% counter-tariff.

This sharp rise in tariffs has undoubtedly increased the cost of importing Chinese goods, including cabinets, creating significant challenges for businesses that depend on affordable Chinese imports. However, there are still ways to manage and reduce the financial burden of these tariffs. In this article, we will explore how to take advantage of the latest tariff policies, including Trump’s reciprocal tariffs, and how businesses can import Chinese cabinets into the U.S. with a much lower 10% tariff. By understanding these new tariff regulations and exploring effective strategies to avoid the higher duties, you can continue to import high-quality Chinese cabinets while minimizing your costs.

What are anti-dumping and countervailing duties?

Anti-dumping and countervailing duties are trade remedies that the US government can use to protect its domestic industries from unfair competition from foreign imports. Anti-dumping duties are imposed when a foreign company sells a product in the US at less than its fair value, which is determined by comparing the export price or constructed export price with the normal value of the product. Countervailing duties are imposed when a foreign government provides financial assistance to its exporters or producers, such as subsidies, grants, loans, tax breaks, or other benefits, that give them an unfair advantage over their competitors.

The US Department of Commerce (DOC) is responsible for investigating whether dumping or subsidization has occurred, and calculating the amount of duties to be imposed. The US International Trade Commission (ITC) is responsible for determining whether the domestic industry has been materially injured or threatened with material injury by the imports, and whether there is a causal link between the imports and the injury.

Why did the US impose anti-dumping and countervailing duties on wooden cabinets and vanities from China?

The U.S. government imposed anti-dumping and countervailing duties on wooden cabinets and vanities imported from China. These tariffs were introduced to combat unfair trade practices, as Chinese manufacturers were accused of selling products at below-market prices, subsidized by their government. The primary goal was to protect U.S. manufacturers from being undercut by these low-priced imports.

As of 2023, the U.S. imposed anti-dumping duties of up to 258% on certain Chinese-made cabinets and vanities. These tariffs aim to level the playing field and ensure fair pricing. However, this policy has raised costs for businesses and consumers in the U.S. importing products from China, particularly in the furniture industry. The Trump tariffs have significantly increased import costs, affecting the bottom line for many businesses.

How to avoid high tariffs on imported Chinese cabinets?

One effective strategy to avoid these hefty tariffs is to source your wooden cabinets and vanities from countries not subject to high anti-dumping or countervailing duties. PA Home’s Saudi Arabia factory presents a competitive advantage for businesses looking to sidestep the escalating tariffs on Chinese products.

Thanks to the lower 10% tariff rate on products imported from Saudi Arabia to the U.S., you can reduce your import costs while maintaining high-quality standards. This makes PA Home’s Saudi Arabia facility an ideal solution for businesses seeking cost-effective, high-quality cabinetry without the burden of hefty tariffs. The Trump tariffs have made this even more relevant for U.S. businesses.

By choosing PA Home, you are not only getting premium products but also avoiding unnecessary tariff hikes, leading to significant savings and improved margins.

Why Choose PA Home's Saudi Arabia Factory?

PA Home’s Saudi Arabia factory offers several key advantages that make it a top choice for sourcing high-quality kitchen and bathroom cabinetry:

Learn more about PA Home’s Saudi Arabia Factory.

-

State-of-the-Art Production Line

The Saudi Arabia factory is equipped with advanced Industry 4.0 automated production lines, including cutting-edge machines like electronic cutting saws, automatic edge banding machines, and multi-row drilling machines. These technologies ensure precision and efficiency in production, providing top-quality products every time. -

Largest Fully Automated Production Line in Saudi Arabia

With the largest fully automated production line in Saudi Arabia, PA Home can handle large-scale projects and ensure timely, reliable deliveries. Whether you’re handling residential or commercial projects, the factory’s capacity makes it a reliable partner. -

Experienced Global Workforce

PA Home’s Saudi Arabia professional team, cooperates with more than 350 experts in China, ensures that every project is handled with expertise and care. This collaboration provides robust support at every stage of your order, ensuring seamless execution. -

Low U.S. Tariffs

Unlike Chinese imports, which face tariffs as high as 54%, products from Saudi Arabia are only subject to a 10% tariff when entering the U.S. The Trump tariffs have raised Chinese tariffs significantly, making this low tariff a crucial advantage. This lower tariff rate means that you can save on import costs, enhancing your profit margins and providing better pricing for your clients.

How to Seamlessly Import PA Home's Cabinets to the USA?

Importing high-quality cabinets from PA Home’s Saudi Arabia factory to the U.S. is streamlined and efficient. This is possible thanks to the close collaboration between our Saudi and China facilities. Here’s how we work together to ensure your project is a success:

Comprehensive Support Across Two Professional Team

PA Home’s Saudi Arabia and China teams work hand-in-hand to provide end-to-end support. Our Saudi facility handles production and export, while our China facility manages design and order details. From the moment you initiate your order, both teams work together to meet your requirements. This eliminates potential issues early on. Our seamless collaboration makes sure you get exactly what you need. We ensure a smooth and hassle-free import process for your project.

Full-Service Project Management with Global Expertise

Our project management team combines expertise from both Saudi and China. We offer a full-service experience for each order. As your order progresses, our Chinese team coordinates design and production. Meanwhile, our Saudi team manages the manufacturing and shipping. This approach ensures each step is closely monitored. You’ll always have a direct point of contact for updates and questions. Once the products arrive in the U.S., we provide professional installation services. This ensures everything is set up correctly and ready to use. We help avoid delays and costly mistakes.

Efficient Logistics and Smooth Customs Handling

With our Saudi and China teams working together, we guarantee timely delivery. Our Saudi facility manages production and shipping. The China team handles customs documentation and logistics coordination. We partner with trusted shipping services to manage the entire import process. From customs clearance to final delivery, everything is handled smoothly. This approach lets you focus on your project while we ensure everything arrives on time and in perfect condition.

Conclusion:

In conclusion, importing high-quality cabinets from PA Home’s Saudi Arabia factory to the U.S. offers a smart solution for businesses. With rising tariffs and costs on Chinese imports, sourcing from PA Home reduces these impacts. Because of the latest changes in the tariff landscape, especially the Trump tariffs on Chinese products, PA Home ensures lower import duties and better margins.

PA Home’s seamless process includes design support, expert project management, and efficient logistics. You’ll receive the best products on time and without hassle. By choosing PA Home, you save on costs and gain a trusted partner. PA Home delivers high-quality, cost-effective solutions tailored to your needs. Contact us streamline your import process and elevate your projects.

Our reputation speaks for itself. With us, you don’t just get a manufacturer; you get a partner.

Our replicated Chinese factory in Indonesia promises the same top-tier quality.

We stay updated with both US and Indonesian laws, ensuring you’re always on the right side of regulations.

Our multicultural team bridges these gaps effortlessly.

We understand the importance of timely delivery, and our logistical partnerships ensure minimized lead times.